Best Corporate Tax Software

Best Corporate Tax Software At A Glance

G2 takes pride in showing unbiased reviews on user satisfaction in our ratings and reports. We do not allow paid placements in any of our ratings, rankings, or reports. Learn about our scoring methodologies.

- Overview

- User Satisfaction

- Seller Details

ProConnect Tax brings you a full host of leading-edge features woven together perfectly into one unified and simplified workflow. Go seamlessly from books to tax to advisory in just a few clicks

- Owner

- Accountant

- Accounting

- Financial Services

- 97% Small-Business

- 3% Mid-Market

80,392 Twitter followers

- Overview

- User Satisfaction

- Seller Details

Lacerte is a desktop or hosted professional tax software for large tax and accounting firms that need powerful tools designed for complex returns and multiple preparers. https://accountants.intuit.com

- CPA

- Partner

- Accounting

- 90% Small-Business

- 7% Mid-Market

80,392 Twitter followers

- Overview

- User Satisfaction

- Seller Details

With TurboTax Business, you don’t need to know a thing about business taxes.

- Accounting

- Financial Services

- 82% Small-Business

- 11% Enterprise

80,392 Twitter followers

- Overview

- Pros and Cons

- User Satisfaction

- Seller Details

Avalara makes tax compliance faster, easier, more accurate, reliable, and valuable for 41,000+ business and government customers in over 75 countries. Tax compliance automation software solutions from

- Controller

- CFO

- Retail

- Computer Software

- 48% Mid-Market

- 39% Small-Business

24,917 Twitter followers

- Overview

- Pros and Cons

- User Satisfaction

- Seller Details

Sovos provides businesses with the confidence needed to navigate an increasingly regulated world. Offering a modern, IT driven response to compliance, Sovos’ solutions are scalable, reliable and secur

- Accounting

- Insurance

- 48% Mid-Market

- 40% Enterprise

1,354 Twitter followers

- Overview

- User Satisfaction

- Seller Details

Anusaar by Lenorasoft is our next-generation, SaaS-based TaxTech and RegTech platform that revolutionizes how businesses manage e-invoicing software and financial operations. As an ERP-agnostic, all-i

- 55% Mid-Market

- 45% Enterprise

- Overview

- Pros and Cons

- User Satisfaction

- Seller Details

Drake Tax is comprehensive, all-in-one professional tax software.

- Accounting

- 96% Small-Business

3,053 Twitter followers

- Overview

- User Satisfaction

- Seller Details

Give you the tools, the education and the opportunities you need to make real, meaningful progress

- 64% Small-Business

- 24% Mid-Market

45,551 Twitter followers

- Overview

- Pros and Cons

- User Satisfaction

- Seller Details

UltraTax CS is premium tax and compliance software that provides a comprehensive tax preparation process that utilizes advanced technology and an integrated workflow system with tax planning, document

- Accounting

- 95% Small-Business

- 2% Enterprise

151,653 Twitter followers

- Overview

- User Satisfaction

- Seller Details

Oracle Tax Reporting Cloud is a tax-owned solution that works with your finance systems to help deliver effective, efficient, and transparent corporate tax processes including tax provision and countr

- Accounting

- 40% Mid-Market

- 36% Enterprise

822,135 Twitter followers

- Overview

- User Satisfaction

- Seller Details

A modern API solution for W-9 collection, TIN verifications, 1099 filings, corrections, and more for federal and state-level compliance.

- Financial Services

- 60% Mid-Market

- 27% Small-Business

585 Twitter followers

- Overview

- User Satisfaction

- Seller Details

ProSeries is a tax software that allows you to file returns by managing the tax preparation process from collecting and importing data automatically to filing returns.

- Accountant

- Accounting

- Financial Services

- 85% Small-Business

- 10% Enterprise

80,392 Twitter followers

- Overview

- Pros and Cons

- User Satisfaction

- Seller Details

Vertex software enables tax determination, compliance, and reporting, tax data management, and document management with powerful pre-built integrations to core business applications. Vertex brings

- Tax Manager

- Retail

- Accounting

- 55% Enterprise

- 28% Mid-Market

4,923 Twitter followers

- Overview

- User Satisfaction

- Seller Details

The best choice if you're filing tax returns for your business and for yourself.

- 75% Small-Business

- 20% Enterprise

37,711 Twitter followers

- Overview

- Pros and Cons

- User Satisfaction

- Seller Details

TaxJar is reimagining how businesses manage sales tax compliance. Our cloud-based platform automates the entire sales tax life cycle across all of your sales channels — from calculations and nexus tra

- Owner

- CEO

- Retail

- Consumer Goods

- 88% Small-Business

- 11% Mid-Market

4,056 Twitter followers

- Overview

- User Satisfaction

- Seller Details

CCH ProSystem fx Tax allows you to automate your tax return process with a tax compliance and preparation solution.

- Staff Accountant

- Tax Manager

- Accounting

- 37% Mid-Market

- 31% Small-Business

17,898 Twitter followers

- Overview

- User Satisfaction

- Seller Details

ProSystem fx Suite is an integrated tax and accounting solution that allows you to organize and streamline your tax, accounting and workflow.

- Accounting

- 59% Mid-Market

- 25% Small-Business

17,898 Twitter followers

- Overview

- User Satisfaction

- Seller Details

GoSystem Tax RS is professional tax software that provides a comprehensive tax preparation process that utilizes advanced cloud-native technology and a highly scalable workflow system. It offers acc

- Accounting

- Financial Services

- 84% Enterprise

- 13% Small-Business

151,653 Twitter followers

- Overview

- User Satisfaction

- Seller Details

Tax assistance in keeping track of expenses, mileage, etc

- 92% Small-Business

- 8% Mid-Market

80,392 Twitter followers

- Overview

- User Satisfaction

- Seller Details

Bloomberg Income Tax Planner is a tax planning software solution that manages time, accuracy and more while streamlining the tax planning process and managing your clients' tax burden

- Accounting

- 33% Enterprise

- 33% Small-Business

19,849 Twitter followers

- Overview

- Pros and Cons

- User Satisfaction

- Seller Details

Trolley is the end-to-end payouts platform built for the internet economy, helping businesses make and manage payouts to contractors around the globe. Finance and product teams across hundreds of or

- Information Technology and Services

- 67% Small-Business

- 29% Mid-Market

1,047 Twitter followers

- Overview

- User Satisfaction

- Seller Details

Web-GST by Webtel is a one-stop solution for all your GST filing needs. With Webtel, GST filing gets hassle-free & fast. (i) Seamless Integration with ERPs. (ii) Solution for e-Invoicing and e-W

- Accounting

- 46% Small-Business

- 38% Mid-Market

2,695 Twitter followers

- Overview

- User Satisfaction

- Seller Details

TaxAct Tax-Exempt Organization Edition allows you to prepare one return.TaxAct's depreciation reports make reviewing your current, future, and accumulated assets fast and easy.

- 73% Small-Business

- 18% Enterprise

11,975 Twitter followers

- Overview

- User Satisfaction

- Seller Details

Bloomberg Tax & Accounting Fixed Assets is the cloud-based software solution that automates and manages your fixed assets life cycle from construction and purchase to retirement. Our depreciation

- 53% Mid-Market

- 32% Enterprise

19,849 Twitter followers

- Overview

- User Satisfaction

- Seller Details

Corptax transforms the business of tax through technology, business process expertise and award-winning support. Clients achieve breakthrough tax performance using the first and only single-platform s

- Accounting

- 79% Enterprise

- 21% Mid-Market

315 Twitter followers

- Overview

- User Satisfaction

- Seller Details

ClearTax Global E-Invoicing Solution: Your One-Stop for Everything E-Invoicing ClearTax is the world’s largest enterprise tax and compliance solutions provider, trusted by over 5,000 enterprises glob

- Accounting

- 47% Small-Business

- 41% Enterprise

149 Twitter followers

- Overview

- User Satisfaction

- Seller Details

Taxrates.io delivers US Sales tax, VAT and GST rates directly to you through intelligent automation.

- 86% Small-Business

- 14% Mid-Market

- Overview

- User Satisfaction

- Seller Details

Tax1099 powered by Zenwork, Inc., is an IRS-approved eFile provider for informational returns. We make it easy to file 1099s, W-2s, the 1040s, and other 40+ state and federal forms quickly and accurat

- Accounting

- 73% Small-Business

- 9% Mid-Market

- Overview

- User Satisfaction

- Seller Details

GruntWorx Technologies replace manual organization & data entry, freeing tax professionals from tedious tasks, so they can focus on profit.

- 40% Small-Business

- 20% Mid-Market

321 Twitter followers

- Overview

- User Satisfaction

- Seller Details

Track1099 is an online solution to file 1099 forms.

- 80% Small-Business

- 20% Mid-Market

- Overview

- User Satisfaction

- Seller Details

Gen GST Online is a safe and secure software solution for filing taxes under GST law. It is compatible with all major operating systems and is built using the highly reliable Java language, commonly u

- 100% Small-Business

8,196 Twitter followers

- Overview

- Pros and Cons

- User Satisfaction

- Seller Details

Designed by CPAs and tax attorneys, TaxBit is the leading tax and accounting solution for the tokenized economy. TaxBit's platform serves the industry's top exchanges, institutional investors, governm

- 55% Small-Business

- 27% Mid-Market

14,566 Twitter followers

- Overview

- User Satisfaction

- Seller Details

Commenda is the AI-powered global business console. Click-to-expand and operate anywhere on Earth. From Transfer Pricing and Global VAT, GST, and Sales Tax to Corporate Tax and Accounting, Commend

- 50% Mid-Market

- 50% Small-Business

- Overview

- User Satisfaction

- Seller Details

Gen TDS is an e-filing software that makes it easy to fill out online TDS/TCS returns quickly. It includes all the specifications needed for e-filing. TRACES regulations mandate the filing of TCS and

- 67% Mid-Market

- 33% Small-Business

8,196 Twitter followers

- Overview

- User Satisfaction

- Seller Details

TaxRaahi offers a GST Return Filing Software, designed to offer users all the updates on GST Bills and information on how it will affect them through articles, videos and more.

- 67% Mid-Market

- 33% Small-Business

- Overview

- User Satisfaction

- Seller Details

Hurdlr is a smart mobile app for independent workers, freelancers and solopreneurs to seamlessly manage their "business" finances in seconds. Not days, hours, or even minutes.

- Real Estate

- 91% Small-Business

- 9% Mid-Market

1,097 Twitter followers

- Overview

- User Satisfaction

- Seller Details

CheckMark 1099 Software is a powerful and easy-to-use tax filing software designed to help businesses like yours prepare, mail, print, and e-file 1099 forms quickly and accurately with the IRS, saving

- 100% Small-Business

404 Twitter followers

- Overview

- User Satisfaction

- Seller Details

Gen Income tax is software for ITR filing and interest calculations under the Income-tax sections. It is developed by SAG Infotech Pvt Ltd. Gen IT software also generates ITR-1 to ITR-7 form. The soft

- 67% Mid-Market

- 33% Small-Business

8,196 Twitter followers

- Overview

- User Satisfaction

- Seller Details

Genius is the unlimited tax return filing and management software which has six module packages including Gen IT, Gen BAL, Gen TDS, Gen CMA, Form Manager, and AIR/SFT. The software has lots of feature

- 50% Mid-Market

- 50% Small-Business

8,196 Twitter followers

- Overview

- User Satisfaction

- Seller Details

K1x is the leading data distribution platform for alternative investments tax compliance. The fintech company's patented, AI-powered SaaS solution digitizes and distributes IRS Schedules K-1, K-3, and

- 100% Mid-Market

- Overview

- User Satisfaction

- Seller Details

Spectrum Tax Software - A Complete Software Package for All Your Income Tax & TDS Compliances Spectrum combines Zen Income Tax Auditor Edition, Zen e-TDS, Document Manager, Project Report/CMA, an

- 100% Small-Business

4,155 Twitter followers

- Overview

- User Satisfaction

- Seller Details

Experience the Fastest GST Filing Software with 6000 Invoices Matching at Once WeP has 20 Years of Experienced in Digital Transformation Solutions. We are the Licensed GST Suvidha Provider(GSP).

- 100% Small-Business

- Overview

- User Satisfaction

- Seller Details

Yearli is an online tax filing platform.

- 50% Mid-Market

- 50% Small-Business

- Overview

- User Satisfaction

- Seller Details

Alphatax is the UK and Ireland's No. 1 enterprise corporation tax compliance software solution with over 1,100 customers including 43% of the UK FTSE 100 and 23 of the top 25 Accountancy firms. Devel

- 100% Small-Business

- Overview

- User Satisfaction

- Seller Details

Reduce risk and overall compliance costs with cloud-based communications tax calculation and reporting, designed specifically for communications service providers.

- 100% Small-Business

17,898 Twitter followers

- Overview

- User Satisfaction

- Seller Details

CrossLink is the software of choice for tax professionals. Offering both online and desktop solutions, CrossLink is fast, simple, and straight-forward software that grows with your business no matter

- 100% Small-Business

442 Twitter followers

- Overview

- User Satisfaction

- Seller Details

Remove the guesswork in tax jurisdiction assignments by identifying accurate local tax rates instantly. Learn more at: https://www.precisely.com/product/precisely-spectrum-geocoding/spectrum-enterpri

- 100% Small-Business

3,981 Twitter followers

- Overview

- User Satisfaction

- Seller Details

GSTHero aims to help businesses finance more simplified . As a GSP*, we work closely with the GSTN team. We test and identify gaps for the GSTN team, and help improve the GST process. With such an a

- 100% Mid-Market

- Overview

- User Satisfaction

- Seller Details

Klikpajak is Indonesia-based tax management for individuals and businesses.

- 100% Small-Business

168 Twitter followers

- Overview

- User Satisfaction

- Seller Details

Reduce Tax Penalty Risk with W-9 and W-8BEN IRS Form Collection and Vetting

- 100% Small-Business

2,418 Twitter followers

- Overview

- User Satisfaction

- Seller Details

OnlineFileTaxes enables users to e-file 1099s and other tax forms.

- 100% Small-Business

- Overview

- User Satisfaction

- Seller Details

Sales Tax DataLINK offers comprehensive software and services for sales tax compliance. Our Rates database is pre-configured for sales and use tax calculations specific to your needs. We include max

- 50% Mid-Market

- 50% Small-Business

107 Twitter followers

- Overview

- User Satisfaction

- Seller Details

SimpleTax is a HMRC recognised software, designed to be a simple way of calculating and submitting a self-assessment return.

- 100% Small-Business

2,466 Twitter followers

- Overview

- User Satisfaction

- Seller Details

1099 Pro is a leading provider of software and services for tax information reporting, including solutions for 1099 forms, tax identification number (TIN) matching and electronic filing. Our comprehen

- 100% Small-Business

1,354 Twitter followers

- Overview

- User Satisfaction

- Seller Details

Powerful, professional tax software that offers prices you'll love & a support team who cares. TaxAct Professional has a legacy of 23 years & over 40 million successfully processed e-files. In

- 100% Small-Business

11,975 Twitter followers

- Overview

- User Satisfaction

- Seller Details

Tax Bandits offers efficient, secure, and affordable way to e-file IRS tax returns for small businesses and nonprofit organizations.

- 100% Small-Business

- Overview

- Pros and Cons

- User Satisfaction

- Seller Details

tax.com™'s comprehensive indirect tax Software as a Service (SaaS) solutions are designed to assist businesses in North America with their tax-related needs. This platform offers a range of functiona

- 50% Enterprise

- 50% Small-Business

- Overview

- User Satisfaction

- Seller Details

TaxTank is a cloud-based software aimed at empowering individual taxpayers to proactively self-manage their income and property taxes to ultimately pay less tax.

- 100% Small-Business

- Overview

- User Satisfaction

- Seller Details

TDSMAN is the complete TDS & TCS return preparation software exclusively designed as per the system specified by NSDL in line with the requirements of the Income Tax Department, Govt. of India. Th

- Overview

- User Satisfaction

- Seller Details

TaxRaahi offers a TDS Software, designed to file TDS return, generate and submit FVU file within the software.

- 100% Small-Business

- Overview

- User Satisfaction

- Seller Details

CFS Tax Software, Inc. is a leading developer of tax utility software for tax professionals.

- 100% Small-Business

- Overview

- User Satisfaction

- Seller Details

W2 Mate fits the needs of most users regardless of their W2 and 1099 Forms preparation needs.

- 100% Mid-Market

- Overview

- User Satisfaction

- Seller Details

WorkingPoint is an accounting software for small businsses that helps track income and expenses, create and send invoices, pay bills, manage cash, track inventory, and communicate with customers.

- 100% Small-Business

1,183 Twitter followers

- Overview

- User Satisfaction

- Seller Details

Write-Up is a software of transactions recording and stock accounting solution that simplifies tax reporting for Canadian holding companies, estates, and trusts.

- 100% Small-Business

- 100% Enterprise

- Overview

- User Satisfaction

- Seller Details

1099online offers an advanced and secure solution for e-filing of 1099 forms.

76 Twitter followers

- Overview

- User Satisfaction

- Seller Details

ACAwise was created in 2016 by SPAN Enterprises, a seasoned IRS e-file provider with extensive experience in the software and e-filing industries.

- Overview

- User Satisfaction

- Seller Details

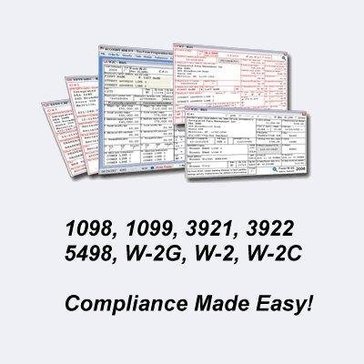

Account Ability is a network ready software application that fulfills the needs of small to midsize businesses with a simple, yet powerful, solution to the complicated job of annual 1095, 1098, 1099,

- Overview

- User Satisfaction

- Seller Details

- Overview

- User Satisfaction

- Seller Details

The AirPTS 1040 suite of professional tax software solutions is built based on the needs of your high-volume tax business and enables the efficiency and reliability that are essential to your success.

9 Twitter followers

- Overview

- User Satisfaction

- Seller Details

- Overview

- User Satisfaction

- Seller Details

Simple tax reporting. File 1099, W-2, and Affordable Care Act forms with one product.

- Overview

- Pros and Cons

- User Satisfaction

- Seller Details

Modernize your practice with Caseware Cloud, a flexible, secure cloud-based platform built to meet the needs of future-focused audit and accounting functions. Caseware Cloud boasts over 85 cloud appli

- 67% Small-Business

- 33% Mid-Market

5,853 Twitter followers

- Overview

- User Satisfaction

- Seller Details

10,770 Twitter followers

- Overview

- User Satisfaction

- Seller Details

CheckMark 1095 Software is a professional-grade solution that allows businesses to easily and affordably report and file or transmit ACA (Affordable Care Act) requirements of health care coverage prov

404 Twitter followers

- Overview

- User Satisfaction

- Seller Details

- Overview

- User Satisfaction

- Seller Details

Corvee provides tax, accounting and financial advising firms with the ability to make smarter tax decisions for their clients while growing and optimizing their firm. The company’s flagship product, C

- Overview

- User Satisfaction

- Seller Details

Depreciation Calculator figures out depreciation using tax and GAAP methods to make accurate depreciation schedules.

- Overview

- User Satisfaction

- Seller Details

Diagnostax is experts in tax diagnostics providing a comprehensive, web-based, tax diagnostics toolkit focussed in three key tax areas: HNWs, Unincorporated Businesses and Corporates.

278 Twitter followers

- Overview

- User Satisfaction

- Seller Details

DisclosureLINK is the only available software for automating voluntary disclosure accounting.

107 Twitter followers

- Overview

- User Satisfaction

- Seller Details

E-File Magic is an online 1098 software solution.

- Overview

- User Satisfaction

- Seller Details

Backed by the tax pros LibertyTax, eSmart Tax makes sense of tax forms. eSmart Tax makes it easy for you to file your tax return and get your refund fast.

5,020 Twitter followers

- Overview

- User Satisfaction

- Seller Details

Express GST is a cloud-based GST software that simplifies filing GST returns for businesses in India. It offers features like automatic data import from Excel, multiple validations to ensure error-fre

4,155 Twitter followers

- Overview

- User Satisfaction

- Seller Details

FAMS is a comprehensive, easy-to-use fixed asset accounting software system for complete asset accounting and asset management.

2,899 Twitter followers

- Overview

- User Satisfaction

- Seller Details

FileLINK‘s intuitive, point-and-click dashboard gives you more control and more safeguards over the filing process, streamlining your work. Simply upload your tax data files without file restrictions.

107 Twitter followers

- Overview

- User Satisfaction

- Seller Details

Finally is an all-in-one accounting and finance platform tailored for small to medium-sized businesses. It offers a complete suite of financial tools—bookkeeping, taxes, expense management, payroll, a

- Overview

- User Satisfaction

- Seller Details

Fixed asset depreciation software that provides categorized assets tracking, depreciation adjustments/deletion, and reporting features.

- Overview

- User Satisfaction

- Seller Details

Simply answer the questions to create the documents required for final tax return

67,166 Twitter followers

- Overview

- User Satisfaction

- Seller Details

FuelTax helps you to create fuel tax report for IFTA filing. IFTA return is based on actual miles and/or calculated miles. Track information of shippers, drivers, tractors and trailers.

- Overview

- User Satisfaction

- Seller Details

At Gelt, we are dedicated to providing premium tax solutions that empower you to keep more of your hard-earned money. With a team of experienced CPAs and the integration of cutting-edge technology, we

- Overview

- User Satisfaction

- Seller Details

Gen XBRL Software would be an effective tool for the professionals such as Company Secretaries and Chartered Accountants who are being imposed to waste important time on the preparation and e-filing o

- Overview

- User Satisfaction

- Seller Details

GST Keeper offers a comprehensive range of tax compliance solutions.

179 Twitter followers

- Overview

- User Satisfaction

- Seller Details

HdL Prime is HdL's local tax software solution. HdL Prime facilitates efficient data processing and the sharing of critical information across departments while improving timely communication between

- Overview

- User Satisfaction

- Seller Details

Inkle is an accounting and tax SaaS platform designed to help U.S. startups manage their operations right from inception. Used by over 6% YC companies globally.

565 Twitter followers

- Overview

- User Satisfaction

- Seller Details

IRIS GST, a business line of IRIS Business Services Limited, is an authorized GSP with a team of Chartered Accountants, Data Scientists and Technology Experts.IRIS GST has been associated with the GST

- Overview

- User Satisfaction

- Seller Details

CONTROL YOUR TAX ADVISORY, COMPLIANCE AND CORPORATE DOCUMENTS In a rapidly changing world global legal and tax legislation both become increasingly complicated. Gaining and keeping the overview conse

- Overview

- User Satisfaction

- Seller Details

Komplitax is a GST solution for tax filing, invoicing and accounting.

- Overview

- User Satisfaction

- Seller Details

An integrated tax platform that helps companies to manage their entire tax process

- Overview

- User Satisfaction

- Seller Details

We help you understand, claim and file your GST. KYSS is helping small businesses across India save up to 10% of their turnover in GST and helping them to spend more time growing their business instea

- Overview

- User Satisfaction

- Seller Details

Tax Lien Software Platform in the Cloud

- Overview

- User Satisfaction

- Seller Details

Loctax streamlines compliance, risk, and governance for in-house tax teams with a unified data repository, process automation and reporting. Have a holistic overview of your complete tax function and

Learn More About Corporate Tax Software

What is Corporate Tax Software?

This type of software is specially designed for businesses and is not a good option for individuals. While companies of all sizes and from any industry can use it, corporate tax software is usually more beneficial for businesses that need to comply with complex tax regulations across multiple locations and manage large volumes of transactions that are impacted by these regulations.

Buyers considering this type of software should try to evaluate if it is worth the investment. This can be accomplished by estimating the time it takes employees to manage taxes and the total amount of penalties incurred due to noncompliance. A corporate tax solution will only be effective when the time saved by a business outweighs the investment in this type of software.

Another critical factor to take into account when evaluating corporate tax software is the growth of the company and how it will impact its tax-processing activities. For instance, a company that intends to expand into new markets on other continents will need to make sure that the solution chosen helps the business comply with tax regulations specific to the new locations.

Why Use Corporate Tax Software?

While companies tend to consider tax management a necessary evil and a burden, many businesses are embracing corporate responsibility principles of transparency and accountability to differentiate themselves from competitors.

Compliance — There are many penalties that companies may incur for failure to file or failure to pay corporate taxes. Criminal liability is another consequence of noncompliance and can lead to the seizure of assets and even jail time.

Compliance is also crucial for the reputation of a company. Public companies need to be particularly careful when it comes to tax compliance because they are more likely to be subject to scrutiny by shareholders, customers, and the public. Research shows that “compliance is positively related to being publicly traded and in a highly regulated industry so that characteristics that assure public disclosure of information also tend to encourage better tax compliance."

Accurate financial information — Aside from the obligation to comply with financial regulations, having accurate financial information is critical to the profitability of a company. Even small changes in taxes can have a significant impact on the revenue of a company when applied to thousands (or tens of thousands) of transactions.

Avoid tax processing errors — Tax processing errors are usually caused by inefficient business processes, outdated technology, and poor data quality. Errors can lead to penalties for noncompliance but can also take a lot of time and effort to fix. According to a Deloitte study, tax departments of companies that have not adopted technology spend up to 75% of their time on tax compliance, while businesses who use software can reduce the time spent on compliance to 20%.

Add economic value and contribute to society — It is well known that tax money funds most government investments. Corporate responsibility is also becoming a major priority for many companies, mostly due to the pressure of new generations of customers. By accurately managing and filing taxes, companies contribute to the economy and society and forge relationships with customers and consumers based on trust and transparency.

Take advantage of tax breaks, credits, and exemptions — Many companies that could benefit from tax breaks are not aware of the rules and procedures required (or are discouraged by their complexity). Corporate tax software can help with providing information on what options are available for each company depending on its size, industry, or other characteristics that may allow them to qualify for tax breaks.

What are the Different Kinds of Corporate Tax Software?

Like most financial software, this type of software can be delivered in the cloud or implemented on premises; in addition, vendors offer it as a standalone solution or packaged with other software. Each option has pros an cons that buyers need to take into account. As a rule, standalone cloud solutions are more affordable but not very sophisticated, while software suites are more expensive but offer more robust functionality.

Who Uses Corporate Tax software?

Accounting professionals who are responsible for tax management use this type of software to determine what taxes need to be processed, how, and when.

Executives, such as CFOs and CEOs, use corporate tax software to monitor activities related to tax management and ensure that the company complies with tax regulations.

Independent accountants use this types of software to help their customers with tax management compliance.

Corporate Tax Software Features

Corporate tax software comes in different flavors, and vendors tend to offer various tools or versions of the same solution for different needs. The features offered can vary by industry or company size and can be categorized into two main groups: basic and advanced functionality.

All corporate tax solutions should cover the essential features described above to qualify for inclusion in this category.

Basic features:

Tax rules and rates management functionality is a must for this type of software. It is also important to adjust rates and update rules based on any changes made by local, state, or national governments.

Workflows and schedules allow companies to plan all activities related to tax filing and payment, thus avoiding penalties for noncompliance. This type of functionality also helps users stay organized and productive.

Tax filing features allow users to submit all information and the documents required by law. It should include checklists for each tax category to ensure that everything is ready before filling.

In addition, corporate tax software includes information on tax breaks, how companies can determine if they qualify, and procedures to apply and track applications.

Reporting and analytics features are critical for this type of software because they allow users to track the efficiency of their activities and the accuracy of the tax information.

Reporting and analytics features are critical for this type of software because they allow users to track the efficiency of their activities and the accuracy of the tax information.

Advanced features:

Consolidation of tax information from multiple business entities across various locations is vital for medium to large companies.

Risk assessment and management allows businesses to identify and address potential issues that can lead to noncompliance.

Financial consolidation is used to gather tax information from multiple ERP and accounting systems across various locations.

Potential Issues with Corporate Tax Software

Integration with accounting is critical but isn’t always easy for several reasons. Many companies still use old accounting software that can seldom integrate with corporate tax software, which is often delivered as a cloud model. In addition, the chart of accounts used by companies does not always include GL accounts for all types of taxes. This makes it difficult for companies to match the fields in their accounting system with those used by corporate tax management solutions.

Limited internationalization is a significant issue for companies that expand into new markets and geographical locations. For instance, a company that does business in the U.S. and Canada but also intends to open offices in Europe will not benefit from a corporate tax management solution that only covers North American tax regulations.

The lack of user expertise can impact the adoption of corporate tax software. Despite significant technological advancements, this type of software does not miraculously solve all corporate tax challenges. Its users still need to have the knowledge and experience to understand how to better implement and use the software.