I attended my first AdExchanger Programmatic I/O conference in New York City earlier this month, and there was so much content throughout the two day event.

The entire conference, I was jumping between sessions to ensure I could attend the ones most important to me. The conference did an excellent job mixing in presentations and panel discussions (which I find the most engaging), as well as sessions focused on high-level trends impacting programmatic advertising and recurrent operational trends. In this article, I’ll highlight my top takeaways and how they impact programmatic advertising and AdTech as a whole.

Top three takeaways:

- CTV (connected TV) and OTT (over-the-top) advertising will continue to grow

- The increase in data privacy regulations will continue to impact AdTech and targeted advertising

- SPO (supply path optimization) will bring transparency to programmatic advertising

CTV (connected TV) and OTT (over-the-top) advertising will continue to grow

One consistent trend brought up numerous times was the continued growth of CTV and OTT content. Before diving into what I learned, I want to quickly define CTV and OTT. CTV, or connected TV or smart TV, refers to any type of TV that connects to the internet to access information beyond regular cable television offerings. OTT, or over-the-top, content is used on the internet with the support of multisystem operators.

People opting for CTVs, also known as cord cutters, cut the cord for a variety of reasons. Some reasons include the simple fact that streaming capabilities are improving (look at the slow roll out of 5G), it’s usually cheaper than cable television, and more original content is created on these platforms (hello - Stranger Things, The Marvelous Mrs. Maisel, The Crown).

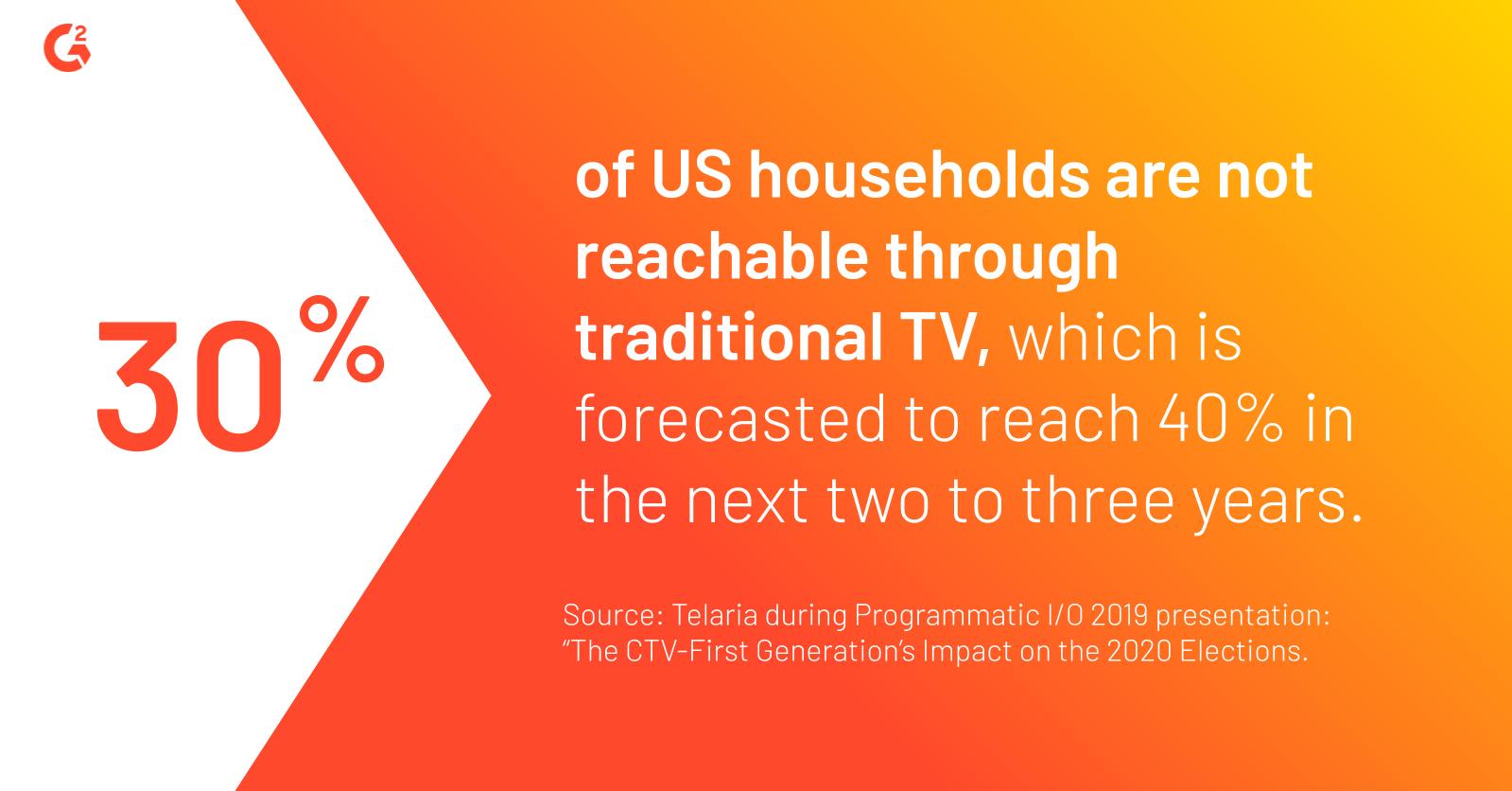

During Telaria’s presentation about how this generation of CTV users will impact the 2020 elections, it was stated that 30% of households in the United States aren’t reachable through traditional TV. In the next two or three years this percentage could reach 40%. Additionally, it was highlighted during a presentation from eMarketer that next year, CTV will account for more programmatic video ad dollars than desktop or laptop ad dollars.

As more people opt for CTVs, more marketers are considering OTT and CTV advertising. Additionally, CTVs offer better audience segmentation and granular targeting due to all the data apps provide. Finally, people aren’t as bothered by CTV ads because they recognize ads are why many of these platforms cost less, giving advertisers a higher ROI.

More players are entering this space, it’s not just Hulu, Netflix, and Amazon Prime anymore. Earlier this year, NBCUniversal announced the name of their streaming service, Peacock, that will stream hits like The Office and Parks and Recreation. Disney will launch Disney+ later this year, giving consumers access to content from brands including Pixar, Marvel, Star Wars, and National Geographic. We’ve also seen acquisitions this year, such as cable giant Viacom buying ad-supported streaming platform Pluto TV for $340 million.

However, there’s a caveat. About 60% of consumers are worried about how their data is used in CTVs, according to a talk during Google’s fireside chat at Programmatic I/O. One thing to consider in the future is how the market will address privacy issues and how they intend to educate audiences about their PII (personally identifiable information). There have already been new updates to the CCPA (California Consumer Privacy Act) that will impact how companies will be able to use consumer’s personal information.

Increases in data privacy regulations will impact AdTech and targeted advertising

There were many sessions devoted to data privacy regulations and how they’re impacting targeted advertising. This isn’t a new trend, but it’s definitely still something marketers are talking about, and rightfully so. Common data collection tools for marketers including cookies, ID matching, and domain tracking continue to be disrupted as privacy regulations increase.

On the second day of the conference, there was a contextual targeting panel, which included executives from the Washington Post, Peer39, and Oracle. Marketers are considering contextual targeting the future of advertising since behavioral targeting is more difficult to accomplish due to privacy regulations. Personalization is still important for targeted advertising—consumers want ads tailored to their preferences and habits. Thus, it’s imperative for advertisers to curate relevant content while adhering to regulations. More marketers will turn to contextual targeting, or displaying ads based on a website’s content. Contextual targeting is less reliant on third-party tracking, making it easier for marketers to comply with privacy regulations while creating customized content for consumers.

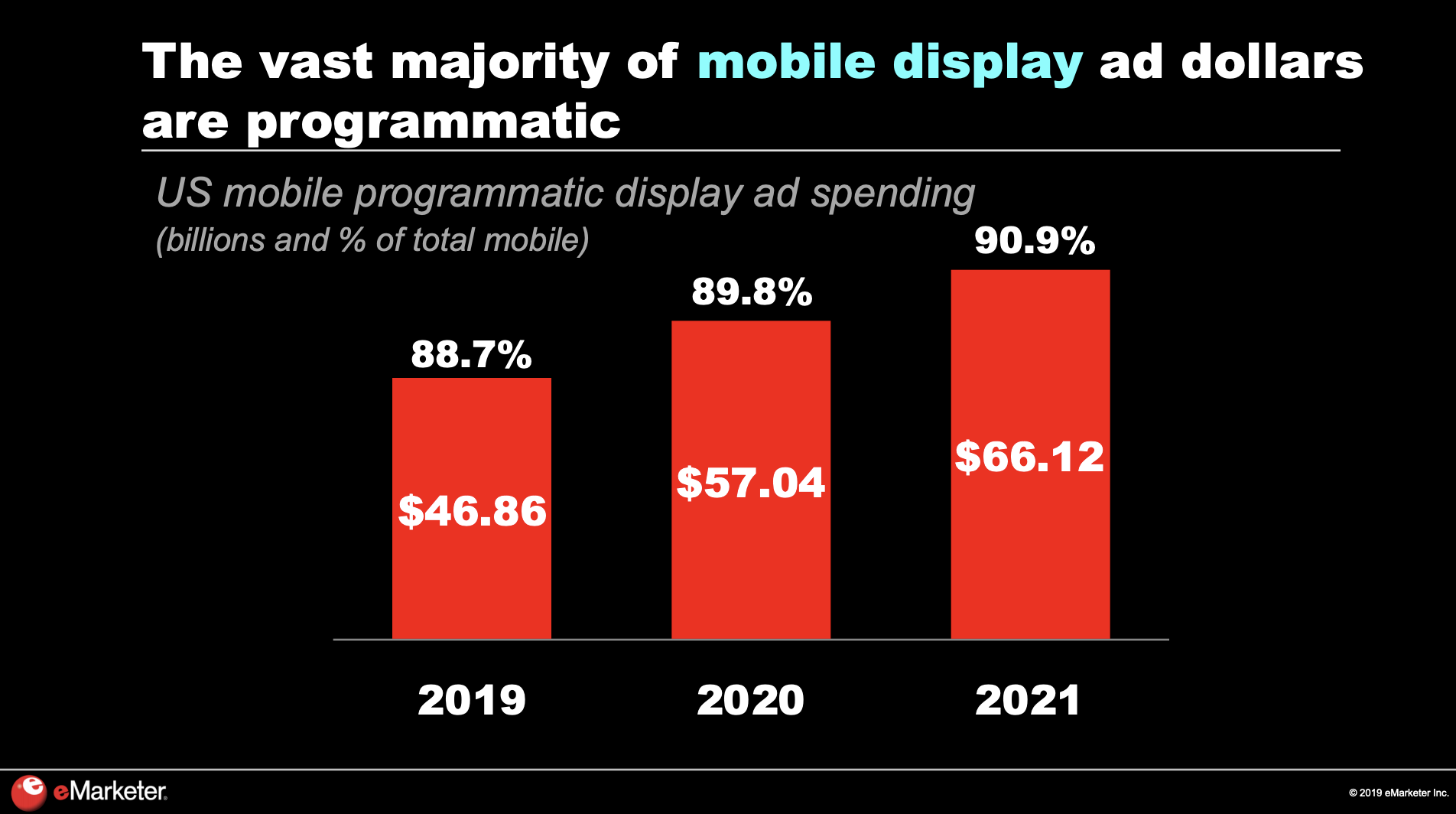

Additionally, mobile advertising is expected to increase since it’s easier for mobile applications to comply with privacy regulations because they do not use cookies or tracking tags the same way mobile web and desktops do. According to eMarketer, the vast majority of mobile display ad dollars are programmatic; they expect mobile programmatic display ad spending in the United States to reach $66.12 billion (90.9% mobile) by 2021.

Source: eMarketer, 2019

Source: eMarketer, 2019

We’ve seen companies prepare for stricter regulations in varying ways including selecting new channels for advertising efforts, gathering more first-party data, and mergers and acquisitions. For example, LiveRamp acquired consent management platform, Faktor, earlier this year. This expands their suite of privacy offerings to help clients manage consent and maintain transparency to comply with the CCPA (California Consumer Privacy Act).

SPO (supply path optimization) will bring more transparency to programmatic advertising

Some session topics were devoted to supply path optimization (SPO), nevertheless, it was mentioned at least once in every session I attended. SPO allows buyers of programmatic ad inventory to optimize which channels they buy impressions from as they purchase their ad inventory. Simply put, it’s an algorithm DSPs (demand-side platforms) use to streamline how they interact with SSPs (supply-side platforms). This can help buyers make data-driven decisions about ad inventory purchases and helps sellers provide lower fraud rates.

One session, Data-Driven Supply Path Optimization, was lead by the founder of Jounce Media, Chris Lane, and discussed SPO in detail. Marketers gain value from SPO via exchange consolidation for operational transparency, financial transparency, and preferred economics. For the buy-side, it keeps the process fair, operating costs decrease, and the price of inventory decreases. For sellers, SPO helps maximize revenue and helps with proprietary demand for ad exchanges.

I’m sure we’ll hear more in the future about SPO and how it benefits the programmatic advertising supply chain.

Many other topics were discussed at Programmatic I/O this year including sourcing media responsibly, the challenges of today’s independent publishers, and keeping emotions in programmatic advertising. The AdTech space is constantly evolving, however, it’s imperative for marketers to stay informed about privacy regulation changes so they adhere to new guidelines. As we see trends such as blockchain, AI, and machine learning evolve, we can expect an impact on the programmatic advertising space as well.

Emily Malis Greathouse

Emily is Director, Market Research at G2. She earned her Bachelor of Science in business administration and Master's of Business Administration degree with a concentration in marketing and business analytics from the Georgia Institute of Technology. She's worked in various industries, including media consulting, information technology, employee wellness, and finance and accounting. She enjoys coaching and volunteering for Girls on the Run, attending concerts and music festivals, running half marathons, and hiking.