Financial technology, aka fintech, recently experienced its first wave of growth and adoption in the United States, where it’s fast becoming integral to financial services companies’ operations.

Banks are relying on know your customer (KYC) and anti-money laundering (AML) tools, which fall under the regtech umbrella, powered by AI to ensure compliance with strict financial services regulations. Investment funds are leveraging financial predictive analytics software to drive improved investment outcomes.

The story across the pond is a little different; Europe has historically lagged in the development and adoption of fintech, as evidenced by European fintechs making up only 17% of the global cumulative valuation of fintechs (around $2.26 trillion). U.S. fintechs, by contrast, make up 48%. But this is likely to change over the next few years, as European regulators have launched a concerted effort to bolster fintech development.

A confluence of factors are converging to create an environment ripe for an explosion of fintech innovation. The advent of Payment Services Directive 2.0 (PSD2) and open banking, Brexit, and the realization of EU regulatory bodies that financial services must be fueled by technological advances are creating the perfect storm to drive fintech development throughout the EU.

Historically, Europe has been less fertile for growing a tech venture than the U.S. and Asia, as evident by the relative lack of European fintech startups prior to the last couple of years. Why is that likely to change? PSD2 will likely be a major catalyst for fintech innovation on the continent. PSD2 was created with two goals: one, to improve competition, thus lowering the cost of financial services and benefitting the consumer; and two, to create open access to banks’ financial data to foster fintech innovation. PSD2’s implementation and the ongoing slow march toward an open banking environment are concrete examples of the EU courting fintech development.

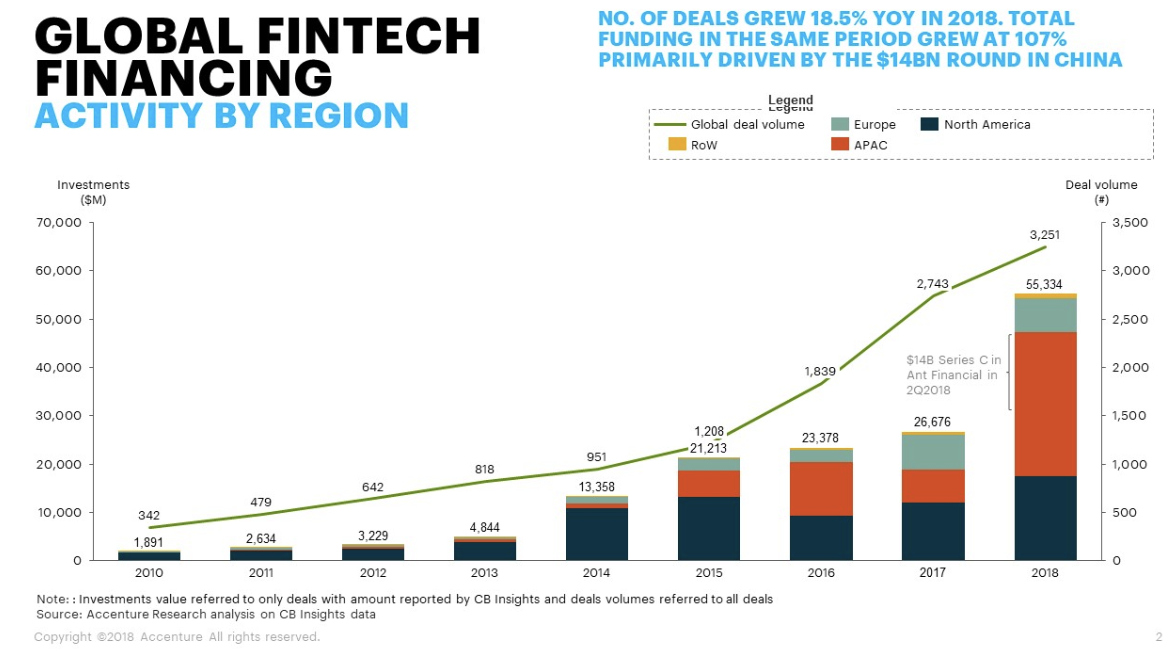

Below is a visual representation of fintech financing by region year by year through 2018. APAC saw a massive increase in 2018, but Europe has been steadily seeing more money flow into fintech ventures.

Source: Accenture

Source: Accenture

There are already examples of European fintech success. N26, the German mobile bank startup-turned-unicorn, is a prime example. All told, there are five fintech unicorns in Europe: N26, Klarna, Revolut, TransferWise, and Monzo. These proven successes should invigorate would-be founders and catalyze other ventures to launch in the financial services space.

The U.K. has done a good job in recent years recognizing fintech’s potential and developing an environment for fintechs to flourish. Massive amounts of money are flowing through the financial services industry, particularly in the U.K. This makes it a prime candidate for testing this technology.

The impact of Brexit affect on fintech in EMEA

There is no doubt that Brexit will damage the U.K.’s financial services industry, which is largely based in London and upon which many European countries rely. Since the results of the ill-fated referendum, however, British financial services software companies have been scrambling to establish capitalized subsidiaries on the continent to mitigate Brexit’s adverse impact. These moves will prove invaluable in ensuring a smooth transition to a Britain-less European Union for fintechs and the financial services institutions that rely on their innovative technology.

Brexit, particularly a no-deal Brexit, which looks more likely every day, will drastically impact fintech innovation, as well as the existing fintech landscape. The U.K. has been a leader in European fintech up to now, fostering innovation through sandboxes and encouraging entrepreneurship. The sandbox they created allowed fintechs to test their products in a live environment without adhering to the strict regulations required outside of the sandbox. It makes sense, as London is the center of the European financial services industry. All that money moving around is tempting for any fintech looking for significant market share and a foothold in the most important European city for finance. Now, companies that are based in the U.K. will be looking to set up shop on the continent and establish connections with the rest of the European market. The U.K. will suffer, but Brexit is likely to be a boon to fintech development in the rest of Europe.

EU banking regulators are already setting up sandboxes and innovation hubs designed to foster the development of cross-border-focused fintech. This approach is modeled after one taken in Britain in 2016 as the U.K. government launched a fintech sandbox. That move catalyzed the development of financial technology in London and helped modernize the existing formidable financial services industry.

In fact, the looming cloud of Brexit may increase urgency for EU fintech development. Big tech has come up against stodgy regulators in the U.K. and found the country less friendly than the U.S. Fintech, however, is a disruptive technology looking to increase competition in the financial services industry and democratize financial tools that were previously only for socioeconomic elites. This effort is much more in line with what has historically been the European ethos (nationalist movements and the recent rise of populism aside) and will lead to fintechs encountering friendlier regulatory environments than ever before in the EU.

Revolut, a UK-based digital bank, has expanded its operations in Lithuania. Lithuania and other Eastern European countries are attracting fintech investment through streamlined application processes for fintechs and the comparatively low operational costs to those in Western Europe. Tech companies looking to expand into financial services product lines will find it more difficult, but while that may slow adoption rates, fintech’s outlook in the EU is rosy.

The future for European fintech

Europe’s fintech outlook is bright. Brexit’s impact, while potentially damaging to the sector in the short term, may prove advantageous to fintech innovation in the long run. The pressure has been put on EU regulators to engineer an environment friendly to innovation, and following in the footsteps of the U.K., they’ve put together a sandbox that will allow fintechs to grow and develop.

Want to learn more about Financial Services Software? Explore Financial Services products.

Patrick Szakiel

Patrick is a Senior Market Research Manager and Senior Analyst (Fintech and Legaltech) at G2. Prior to G2, he worked in a variety of roles, from sales to marketing to teaching, but he enjoys the opportunity to constantly learn and grow that the tech industry provides. Outside of work, Patrick enjoys reading, writing, traveling, jiu-jitsu, playing guitar, and hiking.